This customer experience profile is from 2019. To view this year’s profile, click here.

Virtually every U.S. worker interacts with the Internal Revenue Service at least once a year, and many of them have far more contact as they seek help with finding the right tax forms, figuring out what tax information they need to submit and resolving other issues. In fiscal 2018, taxpayers filed an estimated 250 million tax returns, called the agency for service more than 77 million times, and made nearly 3 million visits to Taxpayer Assistance Centers.

The IRS, whose vital role is to collect the taxes that help pay for our national defense, federal infrastructure, medical research and other important national needs, got high marks from customers for some services in fiscal 2018. Nearly 90% of customers were satisfied with their interactions with IRS employees they reached by phone or visited at assistance centers. Equally impressive is the fact that customers waited an average of only seven minutes to talk with an IRS representative in fiscal 2018 compared with 30 minutes in fiscal 2015. This reduction in wait time can be attributed to an infusion of resources and staffing after several years of budget cuts.

Despite these improvements, the 2019 tax filing season presented challenges, mostly due to factors outside of the agency’s control. The IRS had to implement sweeping new tax law provisions for the 2019 tax season, while also dealing with the effects and aftereffects of a partial government shutdown that sent more than 85% of its workforce home for the majority of the five-week period from December 2018 to January 2019. The agency had to cancel thousands of taxpayer appointments and, when it reopened, callers experienced longer wait times and more difficulty getting through to representatives than they had during the 2018 filing season.

The agency took steps to ensure tax law changes did not negatively affect customer service during the 2019 filing season, implementing a proactive communications campaign to get ahead of frequent taxpayer questions and partnering with professionals who help taxpayers with their tax law questions. Consistent, accurate information disseminated through these channels reduced the need for people to call the agency, according to IRS officials.

The IRS’ web pages could be more user friendly, according to our analysis of selected pages. Additionally, taxpayers were sometimes unable to take advantage of online services because they lacked the documentation needed to meet the requirements for verifying their identity. The IRS is exploring more convenient ways to provide needed security for its online services.

Service Overview

Key Services

- Tax-return processing.

- Tax payment collection and processing.

- Tax refund processing and assistance with inquiries about refund status.

- Access to tax records for individuals and businesses.

- Answers to taxpayer questions about how to fulfill tax responsibilities.

DID YOU KNOW

We estimate that in tax filing season, the IRS averages about 254 calls every minute.

PRIMARY CUSTOMERS

Individuals, businesses, nonprofits and charities that must file taxes as well as tax professionals and organizations that help prepare taxes.

PROFILES ON THE CUSTOMER EXPERIENCE

Airport security screening and passenger support services (TSA) Customs security and screening services (CBP) Citizenship and immigration applicant services (USCIS) Federal student aid applicant services (FSA) Medicare customer support services (CMS) Outpatient health care services for veterans (VHA) Passport services (Bureau of Consular Affairs) Download the full reportOverview1

CALLS2

77.7 million

attempted calls to the IRS customer service line

WAIT TIME3

7.5 minutes

average time to speak with a representative

ONLINE VISITS4

608.8 million

visits to IRS.gov

FACE-TO-FACE- CONTACTS5

413.9 million

contacts through IRS Taxpayer Assistance Centers

RETURNS6

>250 million

tax returns and supplemental documents filed

Social Media Presence

The IRS engages with customers on Twitter, Facebook, Instagram and YouTube. The agency uses social media primarily to inform and educate the public about tax-related issues and to identify common questions and concerns that can be addressed through other channels. Social media comments often provide an early indication of problems or concerns taxpayers are experiencing with an IRS-related matter. The IRS does not resolve or address individual customer issues through social media, given privacy concerns.

As of September 2019, the agency’s social media presence includes:

Twitter

@IRStaxpros

Joined: March 2009

Followers:

59.6K

Likes:

12.3K

IRS news and guidance for tax professionals.

Note: The IRS has two other Twitter handles: @IRSsmallbiz, @IRSTaxSecurity; and two other YouTube channels: IRSVideosmultilingua and IRSvideosASL.

Customer Feedback

The IRS collects customer feedback from many of the channels the agency offers to the public. While it does not publish much of this feedback, possibly due to restrictions imposed by the Paperwork Reduction Act, it does publish the following high-level customer satisfaction scores.

90%

Satisfaction rate for taxpayers who talked with an agent on the IRS’ primary customer service line (fiscal 2018)7

89%

Customer satisfaction with walk-in taxpayer assistance centers (fiscal 2018)8

Additional customer feedback information and insights were garnered through interviews with agency officials, our own analysis of IRS online tools and websites, and reports from the Taxpayer Advocate, an independent unit within the IRS that gives voice to taxpayer concerns

Customer Experience Highlights

- Customers can easily check the status of their tax refunds. The agency provides multiple ways to check refund status, including a “Where’s my refund?” tool on IRS.gov, the IRS2Go mobile app and the IRS refund hotline. Customers use these options extensively—more than 350 million refund status updates were requested through the IRS2Go mobile app and the IRS.gov website between January and June 2019.

- The IRS has reduced the wait time for in-person appointments by helping more people resolve their issues over the phone. In fiscal 2017, IRS contact center representatives began scheduling taxpayer appointments for its Taxpayer Assistance Centers, with the goal of helping these callers address their issues over the phone without having to come in. In fiscal 2018, representatives were able to resolve taxpayers’ issues by phone during more than half the calls. Wait times for in-person appointments fell by 30% and 94% of walk-ins and customers with appointments met with an IRS representative within 30 minutes in fiscal 2018.

- Increases in the budget and staff at call centers, and operational efficiencies, reduced caller wait times. The average wait time dropped to seven minutes in fiscal 2018 from 30 minutes in fiscal 2015. The IRS’ budget was cut by nearly 7% in the five years leading up to fiscal 2015, but starting in fiscal 2016, the IRS received additional funding, including $176 million toward improving taxpayer services.

- Taxpayers commend the professionalism of IRS employees, consistently giving high ratings to the people they interact with at both call centers and taxpayer assistance centers, according to Jim Clifford, the IRS director of customer account services, and Dietra Grant, director of customer assistance, relationships and education, both in the IRS’ Wage and Investment Division.

Our scan of nearly 26,000 social media comments about taxpayer services found examples of posts that can help understand the customer experience, such as people expressing confusion about what tax form to use and complimenting the agency on delivering a speedy refund. Here, we provide one example of a post that reinforces a theme in customer feedback identified in this profile. Along with other topics, our scan revealed positive comments about services provided at in-person taxpayer assistance centers, including the process for scheduling appointments and the quality of service representatives provided.

For example:

“Wow I am pleasantly surprised and never expected an interaction to go so well with the IRS. I came to the San Jose branch this morning and noticed signs for ‘appointments only.’ So I called the appointment line to schedule, and got someone on the line in less than 5 minutes! Not only that but the agent asked why I wanted to schedule an appointment and when I told her, she pulled up my account and answered my questions!!! Amazing experience!”

Opportunities to Improve the Customer Experience

- Stringent security measures hinder taxpayers’ online access to their accounts and IRS services, requiring them to call or visit an assistance center. Only 20% of customers’ first attempts to verify their identity through the IRS’ online system are successful, according to the National Taxpayer Advocate. In many cases, customers did not realize how much documentation they needed to verify their identity. In some cases, they did not have the required documentation, such as an account number for a credit card or a home mortgage in their name. The IRS is striving to improve its secure online services by using “step-up” authentication, according to Clifford. This approach enables taxpayers to access basic information without a rigorous identity check. However, they must pass more rigorous authentication to resolve detailed, account-specific questions.

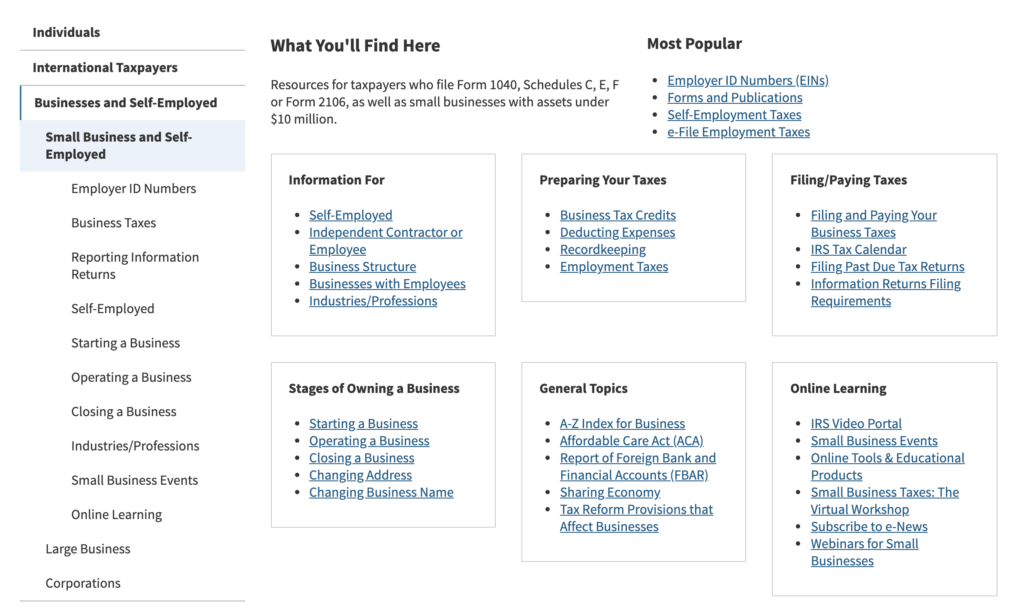

- Some IRS website pages are cluttered with dense and complex information, making it harder for taxpayers to find information quickly and efficiently, according to our analysis. According to agency officials, the IRS continually evaluates the experiences of website visitors through surveys, user testing, evaluation of operational data and other methods, and uses that feedback to improve the online experience. For example, the IRS redesigned website content around the top reasons people call the agency, so people can more easily find the information they need and will not have to call the agency for answers.

- It can be difficult to reach an IRS representative for assistance during the busy tax season. While the IRS has improved telephone access for tax services during most of the year, during the 2019 tax season about one-third of callers to the accounts management line who were routed to an agent for assistance were unable to get through, according to the National Taxpayer Advocate.9 This number was 13% higher than the previous year, partially due to the long-term impact of the 2018-2019 government shutdown, when many IRS employees were furloughed.

- The agency had to cancel more than 16,000 taxpayer appointments during the partial government shutdown that ran from December 2018 to January 2019, according to a report by the National Taxpayer Advocate. When the agency reopened, callers experienced longer wait times, and fewer calls to representatives got through compared with the 2018 filing season.

Our scan of comments on social media found many instances of people struggling to reach an IRS representative. For example:

“@IRSnews I need help, if I am expecting a refund and my banking info was wrong , is it possibly to call and correct the info? I am not having any luck

PROMISING PRACTICE

GETTING AHEAD OF TAXPAYER QUESTIONS ABOUT TAX LAW CHANGES

In response to tax law changes passed in fiscal 2015, the IRS launched coordinated communication campaigns to educate citizens and lessen the need for people to call the agency. The IRS posted information on its website and social media accounts on how taxpayers would be affected by the new law, and partnered with private sector businesses, such as tax-software companies, to ensure taxpayers were getting useful and consistent information.

Rather than seeing an increase in calls to the IRS in fiscal 2017 about the law’s effect on taxpayers, the number of calls dropped by nearly 19% from the previous year. Other factors may have contributed to the drop, but agency leaders believe the communications strategy played a significant role.

During the 2019 tax filing season, this same approach helped limit the number of calls about the major tax reform legislation passed in late 2017, according to Jim Clifford, the IRS director of customer account services. In fact, the IRS received nearly 2 million fewer calls in the 2019 filing season compared with the 2018 filing season, despite the changes in tax law.

Website Experience: How Easy Is It to Navigate and Understand Online Information?

In April 2019, the Partnership and Accenture partnered with the Center for Plain Language, a nonprofit organization that champions clear language, to conduct an analysis of selected IRS web pages that provide information on how to file taxes. Reviewers looked at the pages from the perspectives of two taxpayers: one who wants to e-file for the first time and take a mortgage deduction, and one who wants to learn about options for paying taxes owed.

IRS GRADE

(April 2019)

C+

Note: In a separate study, the center examines a range of government websites annually and issues a Federal Plain Language Report Card. The average grade in calendar year 2018 was a “C.”

What the Analysis Found

Taxpayers can find a range of useful information and resources on the IRS website. For example, the high-level navigation options on the sites primary pages work well. These options focus on major taxpayer needs, such as “File” and “Pay.”

But as the customer drills down into the website, the information and presentation become denser and more complex. We found that tasks often take more clicks than necessary, and the site’s busy appearance can be overwhelming.

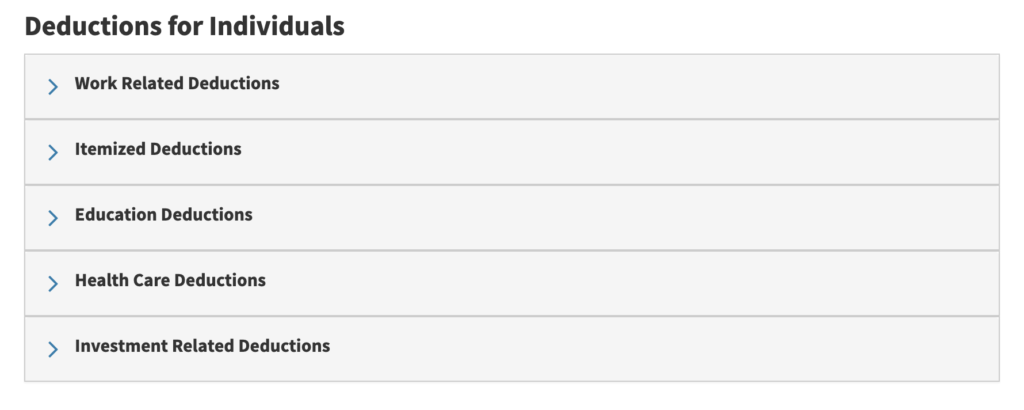

In places, the site is missing key terms, such as “mortgage deduction,” in the headers of relevant sections. Use of familiar terms to identify content would help users find information more easily. Reviewers also found it difficult to locate the appropriate number to call the IRS.

The agency could improve customers’ ability to file their taxes, an already complex task, by making it easier and quicker to use the site.

Figure 1: An overwhelming page with many hyperlinks.

Figure 2: Mortgage deduction information is hard to find because it is grouped under “itemized deductions,” which may be an unfamiliar term for some users.

Indicators that the Customer Experience is a High Priority

The Partnership and Accenture developed the following list of indicators to understand how agencies are prioritizing the customer experience, and steps they can take to improve. The list is based on research about effective customer experience practices in both government and the private sector, and aligns with practices in a customer experience maturity self-assessment for agencies developed by the Office of Management and Budget. Leaders who participate in the Partnership’s federal customer experience roundtable provided input.

More details about our methodology.

Commitment to customer experience

The agency:

Includes high-quality customer experience in its strategic goals.

Yes.

Specifies customer feedback as a key measure of the organization’s performance.

Yes.

The IRS includes customer satisfaction with its accounts management line and its Taxpayer Assistance Centers in its strategic plan.

Has a senior executive with the responsibility and authority to lead efforts to improve customer experience across the organization.

No.

The IRS has a commissioner for the Wage and Investment Division whose work spans some, but not all, of the agency’s primary service delivery channels.

Has a process for standardizing across channels the information and guidance provided to customers.

Yes.

The IRS uses a Customer Early Warning System that allows staff who work with customers to identify issues and update information across channels.

Shares meaningful customer feedback with the public.

No.

The IRS publishes only high-level customer survey results, possibly due to restrictions imposed by the Paperwork Reduction Act.

Customer Service Basics

For the most common services provided, customers can:

Complete frequently used transactions online.

Yes.

Customers can go online and check the status of tax refunds, view their tax accounts, make payments and ask questions about tax law.

Easily find information to call an appropriate representative.

Partially.

The IRS provides phone numbers for its services, our review of the agency website found it was difficult to find these numbers.

Schedule in-person appointments.

Yes.

Obtain status updates.

Yes.

Customers can get online updates on the status of their tax refunds.

Customer Feedback

The agency collects and analyzes data and information on customer perceptions:

Of specific interactions, including website visits, phone calls and in-person appointments.

Yes.

Of the customer journey through a series of interactions or multistage processes that build toward a specific goal.

Yes.

Of the overall service the organization provides.

Yes.

Through qualitative research, such as customer interviews, focus groups, analysis of social media comments or direct observation.

Yes.

Footnotes and Methodology

Footnotes

1 Data is from fiscal 2018.

2 Internal Revenue Service, “National Taxpayer Advocate Annual Report to Congress: 2018,” 23-29. Retrieved from http://bit.ly/2KJAc8N

3 Ibid.

4 Internal Revenue Service, “2018 Data Book.” Retrieved from http://bit.ly/2OX807F

5 Internal Revenue Service, “National Taxpayer Advocate Annual Report to Congress: 2018,” 26. Retrieved from http://bit.ly/2KJAc8N

6 Internal Revenue Service, “2018 Data Book.” Retrieved from http://bit.ly/2OX807F

7 Internal Revenue Service, “2018 Data Book,” 57. Retrieved from http://bit.ly/2OX807F

8 Metric provided by the IRS.

9 Internal Revenue Service, “Fiscal Year 2020 Objectives Report to Congress – Volume 1.” Retrieved from http://bit.ly/2H9hk1Q

Social Media Methodology

Accenture conducted the social media scan using a social media intelligence platform. Using keyword searches, the team identified comments posted from November 2018 through February 2019 about each federal service on popular social media sites such as Twitter, Reddit, Instagram, Yelp, Google and other online forums. The majority (61%) of the posts ultimately included in the analysis were from Twitter.

The team excluded posts primarily containing political commentary and grouped posts to identify themes in customer feedback for each federal service. The methodology allowed us to identify common trends in posts about each service and identify potential issues customers face but cannot be used to draw firm conclusions about the experience of the full range of its customers.

Web Experience Methodology

For each agency, we selected for review a set of web pages that provided information on how customers apply for or access one of the agency’s highest-volume services.

We partnered with the Center for Plain Language to conduct this review. The center followed the same methodology it uses to assess plain language for its annual ClearMark awards for a range of organizations and its annual Federal Plain Language Report Card for the government. This process involved developing two profiles of typical users for each set of agency web pages. The user profiles helped focus reviews on typical tasks, for example, an individual applying for a green card for the first time.

Two plain-language experts individually and independently reviewed and scored each set of pages, using five plain-language criteria to assess each site. They rated each criterion on a five-point scale:

- Information design and navigation.

- Pictures, graphics and charts.

- Style or voice.

- Structure and content.

- Understanding of audience.

The reviewers then met to reach consensus on strengths and weaknesses of each site and to assign a letter grade based on their ratings.

Detailed Methodology for Our Review of Indicators That Customer Experience Is a High Priority

We reviewed each agency and service against indicators that customer experience is a high priority using the following criteria.

Commitment to customer experience

The agency, subagency or bureau:

1. Includes high-quality customer experience in its strategic goals.

Criteria: 1) Customer experience with the agency’s services is listed in the strategic plan as one of the organization’s top priorities, or a supporting goal of one of the priorities; 2) the strategic plan provides specific actions the agency will take to improve customer experience.

2. Specifies customer feedback as a key measure of the organization’s performance.

Criteria: There is a performance measure included in the agency’s strategic plan, annual performance report or on performance.gov that is based on feedback directly from customers.

3. Has a senior executive with the responsibility and authority to lead customer experience efforts.

Criteria: Based on a review of the agency organizational chart and online descriptions of leadership positions, the agency has an executive who meets the following criteria: 1) customer experience is their primary responsibility; 2) they report to the head of their organization, or a deputy; 3) their work spans all major service delivery channels (e.g., online services, contact centers, face-to-face services).

4. Has a process for standardizing across channels the information and guidance provided to customers.

Criteria: At least two service delivery channels have integrated knowledge management systems so that when content for customers on one channel is updated, it is updated on the other channel.

5. Shares meaningful customer feedback with the public.

Criteria: In alignment with the Office of Management and Budget’s guidance on CX measurement, the agency makes public customer feedback that: 1) represents multiple service delivery channels; 2) provides details into different aspects of the experience (e.g., beyond overall customer satisfaction).

Customer service basics

For the most common services provided, customers can:

1. Complete frequently used transactions online.

Criteria: Based on a review of the agency’s website, customers can complete all major services or

transactions online.

2. Easily find information to call an appropriate representative.

Criteria: The agency’s website provides a clear explanation of which number to call for specific issues or provides one number that customers can call to get routed to the appropriate person.

3. Schedule in-person appointments.

Criteria: Based on a review of the agency’s website, customers have the ability to schedule appointments for in-person services.

4. Obtain status updates.

Criteria: Customers can get real-time updates through an online or self-service channel.

Customer feedback

The agency, subagency or bureau collects and analyzes data and information on customer perceptions:

1. Of specific interactions, including website visits, phone calls and in-person appointments.

2. Of the customer journey through a series of interactions or multistage processes that build toward a specific goal.

3. Of the overall service the organization provides.

4. Through qualitative research, such as customer interviews, focus groups, analyzing comments on social media, or direct observation.