This customer experience profile is from 2020. To view this year’s profile, click here.

Executive Summary

The IRS was hit with a double dose of challenges in 2019—the major interruption caused by the 35-day government shutdown that kept tens of thousands of IRS employees from doing their jobs, and the need to implement a sweeping new tax law. Yet by some measures, the IRS still delivered services to taxpayers faster than it did five years ago, when the agency was dealing with a crisis caused by substantial budget cuts.

In fact, in 2019, customers reported high satisfaction levels with the support they received from representatives on the agency’s primary customer service line—even though it can be difficult to reach a representative during the busy tax season.

The IRS also produced or updated several easy-to-use digital tools in the last year to help taxpayers make payments, decide how much money to withhold from their paychecks and complete other tasks. However, some tools require individuals to verify their identity—and many taxpayers struggle to fulfill the agency’s strict authentication requirements, in place to protect the security of sensitive taxpayer information.

These complications were exacerbated by the 2020 coronavirus pandemic, which presented an additional set of challenges. Initial difficulties with teleworking hindered IRS employees’ ability to support customers, correspond by mail, and process paper and some electronic tax returns.

Service Overview

Primary Customers

Individuals, businesses, nonprofits and charities that must file taxes, as well as tax professionals who help others prepare their taxes.

Key services for individual taxpayers

- Tax-return processing.

- Collection and processing of tax payments.

- Processing of tax refunds and assistance with inquiries about refund status.

- Access to tax records.

- Answers to taxpayer questions about how to fulfill tax responsibilities.

Data at a Glance

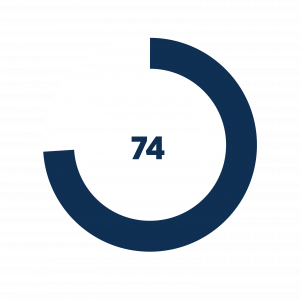

customer satisfaction rate among callers who reached a representative on the primary customer service lines in fiscal 2019

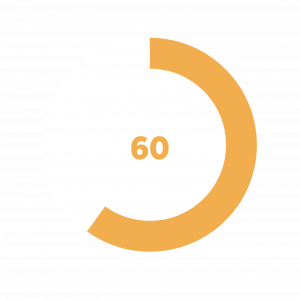

customer satisfaction score for electronic tax filing in 2019

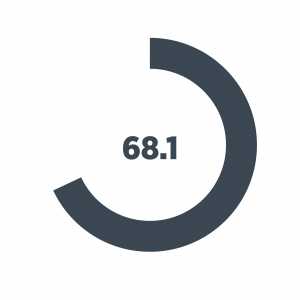

decrease in customers who were able to get through to an agent on the primary customer service lines in fiscal 2019, though this number has improved from five years ago

People Interact With the IRS By

(All data for fiscal year 2019)

CALLING THE IRS CUSTOMER SERVICE LINE

76.8 million

attempted calls to the IRS’ accounts management customer service lines

(77.7 million in fiscal 2018).1

AVERAGE WAIT TIME FOR CALLS

11.3 minutes

to speak with a representative

(7.5 minutes

in fiscal 2018).2

VISITING ONLINE

651 million

visits to IRS.gov

(608.8 million in fiscal 2018).3

Visiting an IRS Taxpayer Assistance Center

Almost 2.4 million

face-to-face contacts through Taxpayer Assistance Centers

(2.9 million

in fiscal 2018).4

Filing a tax return

>253

million

tax returns and supplemental documents filed

(Less than 250 million in fiscal 2018).5

$452 billion

in tax refunds

Customer Experience Insights

Click tabs to expand

In fiscal 2019, the IRS made it easier for customers to complete tasks without having to travel to a Taxpayer Assistance Center.

In fiscal 2019, the IRS made it easier for customers to complete tasks without having to travel to a Taxpayer Assistance Center.

With more taxpayers getting services online or over the phone, the IRS was able to provide in-person services more quickly compared to three years ago, and the agency was in a better position to deal with office closures related to the coronavirus.

Percentage of visitors to Taxpayer Assistance Centers waiting more than 30 minutes for service10

| Fiscal 2016 | 27% |

| Fiscal 2017 | 6% |

| Fiscal 2018 | 6% |

| Fiscal 2019 | 10% |

The agency has focused on addressing taxpayer questions over the phone or online to reduce the number of office visits. In 2019, the IRS educated customers about digital tools such as its DirectPay feature, which people can use to pay taxes online rather than sending a check or bringing payment to an office.

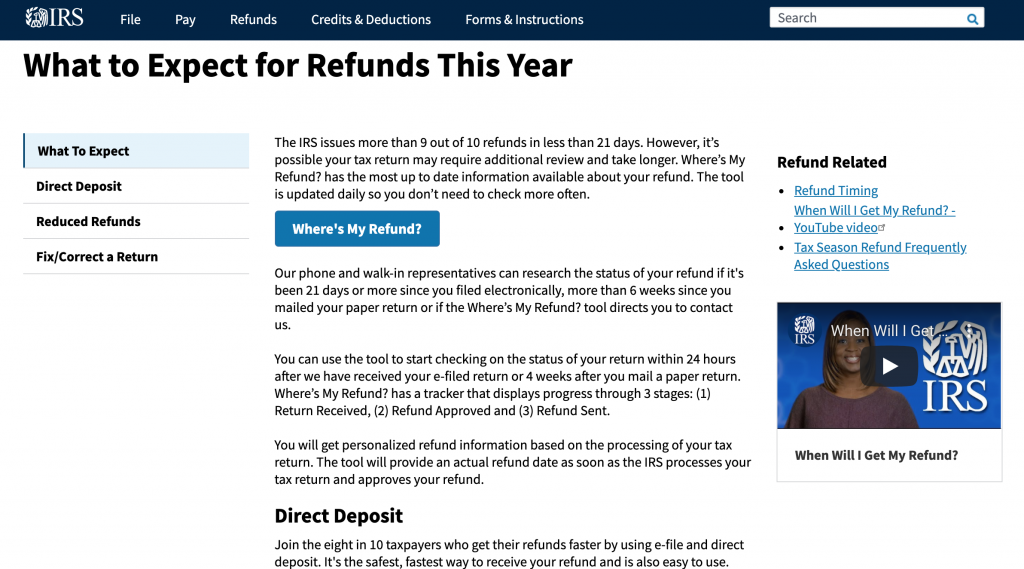

The IRS website offers customers several easy-to-use tools to help them get answers to their questions.

We gave a B+ to selected webpages intended to help users understand how much money to withhold from their paychecks and when they will receive a refund.

Click to see full results of our website experience analysis

Website Experience:

How easy is it to navigate and understand online information?

Reviewers looked at selected webpages from the perspective of people trying to answer two questions:

- What should I expect when receiving my tax refund?

- How much money should I withhold from my paycheck?

IRS Grade

B+

Strengths

- The “Where’s my Refund?” button makes it easy for users to find answers related to their specific tax situations.

- Content explaining when to expect a refund uses clear language that is easy to digest.

- The site clearly explains typical timing for receiving refunds and whom to contact if users do not get theirs within that time.

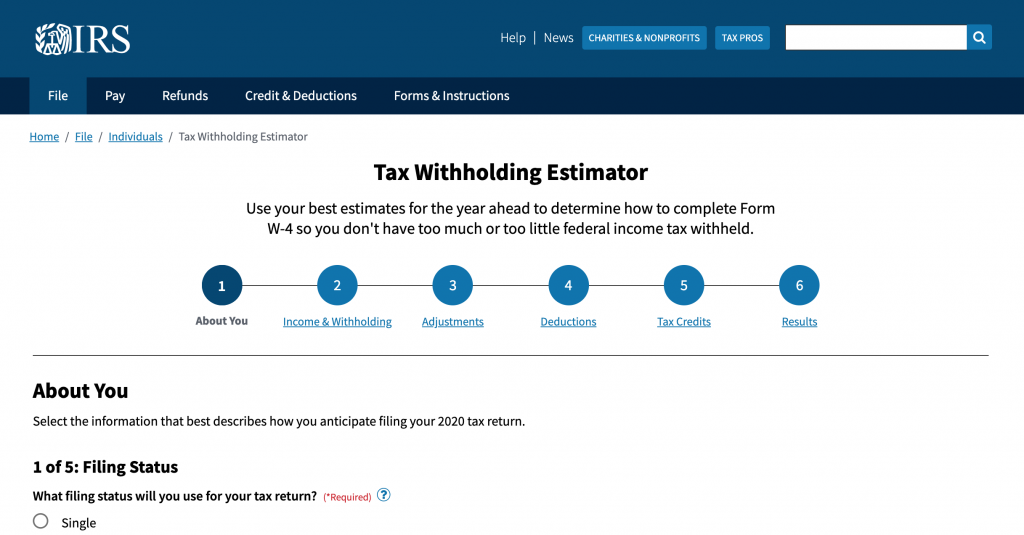

Standout feature: tax withholding calculator

The tax withholding estimator has a clean, simple design, and the webpage is user-oriented. It tells users what information to collect before using the tool, a helpful feature. A navigation guide at the top of the page shows users where they are in the process as they are guided through a set of questions with predefined response options and easy-to-fill fields for data. The website design is effective, and the language is clear and easy to understand.

Opportunities to improve

- Some pages are busy, with multiple pieces of information competing for attention.

It took longer for customers to reach an IRS representative on the agency’s primary customer service line in 2019 compared with 2018, although wait times improved markedly from five years ago.

It took longer for customers to reach an IRS representative on the agency’s primary customer service line in 2019 compared with 2018, although wait times improved markedly from five years ago.

When callers were able to reach a representative on the IRS’ primary customer service lines, they continued to report high a high satisfaction level of 88%.11

However, in fiscal 2019 only 65% of callers to the customer service line who were routed to an agent for assistance were able to get through—an 11% decrease from the prior year. The IRS calls this measure the “level of service.” This decline was partially due to the long-term impact of the 2018-2019 government shutdown, when many IRS employees were furloughed.

Metrics for IRS Customer Service Line (2015-2019)12

| Fiscal 2015 | Fiscal 2016 | Fiscal 2017 | Fiscal 2018 | Fiscal 2019 | |

| Average wait time | 30.5 minutes | 17.8 minutes | 8.4 minutes | 7.5 minutes | 11.3 minutes |

| Level of service | 38% | 53% | 77% | 76% | 65% |

To improve the customer experience, the agency is piloting a virtual callback feature on five of its phone lines. This feature enables customers to keep their place in the queue and receive a callback from a phone agent, rather than waiting on hold. On just one if its phone lines, this feature saved customers an estimated 111,000 hours of hold time, with 77% of customers opting to receive a call back.

The IRS plans to add the option to a total of 15 phone lines (or 40% of its phone demand) in fiscal 2022, and nearly all phone lines by 2024.

Customers increasingly favor submitting tax returns electronically over paper options.

The number of individuals submitting e-file tax returns is on the rise, with nearly 89% of individual returns filed electronically in 2019—about a 10% growth since 2016.13 The agency believes customers favor the electronic process due to its faster processing times and user-friendly features, such as acknowledgement of receipt.

Customer Satisfaction Scores, 2019

individuals filing taxes electronically: 74 out of 10014

individuals filing taxes using paper: 60 out of 10015

government-wide aggregate score: 68.1 out of 100

Users often struggle to verify their identity when accessing certain online services.

Users often struggle to verify their identity when accessing certain online services.

- For fiscal 2019, only 43% of taxpayers attempting to verify their identity and register for a new online account were able to meet IRS’ strict authentication standards.16

Customers may need to verify their identify for several reasons—for example, if their tax return is flagged for potential identity fraud. If customers can’t verify their identity online, they need to call the IRS or visit in person. In 2019, the agency enhanced its online ID verification tool by adding more capabilities, including the ability to handle tax returns from previous years if an older return is flagged for fraud. However, people do not always have all the documentation they need to verify their identities, such as an account number from a mortgage or credit card.

Taxpayers with limited English proficiency cannot yet access important IRS forms and information in their preferred language.

- The IRS’ 10 most commonly filed forms, and many of its online services, are currently available only in English.17

The IRS plans to start publishing these tax forms in six languages in 2021, starting with Spanish. It has already translated some of its online content into Spanish and other languages, and officials say they plan to translate more content over the next few years. As more forms and correspondence become available in other languages, the agency is working on an option for taxpayers to denote their preferred language in their online accounts so the IRS can send them correspondence in that language.

Key

Improvement from last year

Ongoing challenge

Connecting on Social Media

The agency uses social media primarily to inform and educate the public about tax-related issues and to identify common questions and concerns that provide an early indication of problems taxpayers may face—for example, if people are confused about language on an IRS tax form. This enables the agency to address issues quickly, before they become more widespread.

As of September 2020, the IRS’ social media presence related to individual taxpayer services included:

Social media practices

Posts almost daily?

Yes

Responds to customers?

No

Uses multimedia content?

Yes

For background information on these metrics and our full methodology click here.

How the IRS adjusted taxpayer services during the coronavirus

The IRS has faced enormous challenges during the coronavirus pandemic. In March 2020, the agency had to close tax processing centers, Taxpayer Assistance Centers and other offices across the country. The IRS had to manage the busy tax filing season while also delivering economic stimulus payments to millions of customers in a timely manner. To complete these tasks, the agency extended the tax filing deadline by three months, giving taxpayers until July 15 to file and IRS employees more time receive and process tax returns.

Congress passed the CARES Act on March 27. Within a few months, the IRS delivered over 160 million economic stimulus payments to individuals and launched an online tracking tool to help them easily check the status of their payments6 – both notable accomplishments on this timeline and under these circumstances. According to the agency, millions of taxpayers received these payments within 14 days of the CARES Act passing, as compared to the 75 days it took for people to receive stimulus payments during an economic downturn in 2008. Still, some payments were delivered to the wrong individuals and some people had trouble tracking their payments.

The agency also kept up with processing tax returns, going through 146 million individual tax returns by July 24, 2020.7

Despite these efforts, some tax filers experienced challenges with the IRS during the pandemic. IRS offices that process paperwork were either closed or operated at limited capacity, delaying the processing of paper tax returns as well as responses to written correspondence.

Taxpayers trying to call the IRS regarding filings and stimulus payments also had a hard time reaching representatives, with many contact center representatives lacking laptops or other equipment they needed to work from home. When the pandemic began, just 44% of the IRS workforce overall was eligible for telework.8 Throughout the spring and summer the IRS set up more employees for remote work, with 50,000 of approximately 63,000 teleworking by the end of June.9

Indicators that the Customer Experience is a High Priority

Click buttons to expand.

Commitment to Customer Experience

The IRS:

Includes high-quality customer experience in its strategic goals.

Specifies customer feedback as a key measure of the organization’s performance.

Customer satisfaction with the customer service line is included in the IRS’ 2019 annual report.

Has a senior executive with the responsibility and authority to lead efforts to improve customer experience across the organization.

The IRS has a commissioner for the Wage and Investment Division whose work spans some, but not all, of the agency’s primary service delivery channels. The agency also has a director of its Taxpayer First Act office that is developing a comprehensive customer service strategy for the organization.

Improvement from 2019.

Shares meaningful customer feedback data with the public.

The IRS publishes only high-level customer survey results, possibly due to restrictions imposed by the Paperwork Reduction Act.

Customer Service Basics

For the most common services provided, customers can:

Complete frequently used transactions online.

Customers can go online and check the status of tax refunds, view their tax accounts, make payments and ask questions about tax law.

Easily find information to call an appropriate IRS representative.

Improvement from 2019.

Schedule in-person appointments.

Obtain status updates.

Customers can get online updates on the status of their tax refunds.

Has a process for standardizing across channels the information and guidance provided to customers.

The IRS uses a Customer Early Warning System that enables staff members who work with customers to identify issues and update information across channels.

Customer Feedback

The agency collects and analyzes data and information on customer perceptions:

Of specific interactions, including website visits, phone calls and in-person appointments.

Of a customer journey through a series of interactions or multistage processes that build toward a specific goal.

Of the overall service the organization provides.

Through qualitative research, such as customer interviews, focus groups, analysis of social media comments or direct observation.

Through a structured analysis of comments about the service left on social media channels.

Footnotes

1 Taxpayer Advocate Service, 2019 Annual Report to Congress.

4 Ibid.

5 Ibid.

6 IRS press release, June 3, 2020.

7 IRS Filing Season Statistics for Week Ending July 24, 2020.

8 National Treasury Employees Union.

10 Interview with IRS agency officials on March 12, 2020.

11 2019 IRS Databook. This measure reflects only callers who were able to reach a representative. The customer satisfaction score indicates the percentage of respondents who selected the top two choices—“satisfied” or “very satisfied” on a five-point scale.

12 Taxpayer Advocate Service, 2019 Annual Report to Congress.

13 IRS Publication 6186, 2019.

14 ACSI Benchmarks for US Federal Government 2019.

15 Ibid.

16 Taxpayer Advocate Service, 2019 Annual Report to Congress.

17 2020 GAO report.

Social media review methodology

To assess how agencies use social media to interact with customers, we examined three social media best practices identified through conversations with experts: posting frequently, delivering engaging content and responding to questions. We analyzed the most active Facebook or Twitter account by selecting specific months to examine trends throughout the year, including changes to social media activity during the coronavirus.

The team defined posting almost daily as meaning the agency posted for at least 25 out of 30 days on average in September 2019, December 2019, March 2020 and May 2020. Includes multimedia content is defined as whether the agency posted a range of multimedia content with interactive elements beyond just static images. Responds to customers is defined as whether or not agencies respond to questions through the direct message feature on Facebook or in the comment section of posts. To assess this, we examined September 2019, December 2019 and April 2020 (or another month when data was not available). “No” indicates the agency never or rarely responds to comments; “Yes – occasionally” indicates the agency responds sometimes, but there does not appear to be a consistent pattern over time; and “Yes – regularly” indicates the agency responds to comments on a frequent and consistent basis over time.

The number of tweets, likes, posts and views reflect the total activity since the social media account was established.

Website experience methodology

For each agency, we selected for review a set of webpages that customers would theoretically visit to seek answers to frequently asked questions, vetted with each agency.

We partnered with the Center for Plain Language to conduct this review. The center followed the same methodology it uses to assess plain language for its annual ClearMark awards for a range of organizations and its annual Federal Plain Language Report Card for the government. Two plain-language experts individually and independently reviewed and scored each set of pages, using five plain-language criteria to assess each site. They rated each criterion on a five-point scale:

- Information design and navigation.

- Pictures, graphics and charts.

- Style or voice.

- Structure and content.

- Understanding of audience.

The reviewers then met to reach consensus on strengths and weaknesses of each site and to assign a letter grade based on their ratings.

Customer experience indicators methodology

The Partnership and Accenture developed the following list of indicators to understand how agencies prioritize the customer experience, and steps they can take to improve. The list is based on research about effective customer experience practices in both government and the private sector, and aligns with practices in a customer experience maturity self-assessment for agencies developed by the Office of Management and Budget. Leaders who participated in the Partnership’s federal customer experience roundtable provided input.

Commitment to customer experience

The agency:

- Includes high-quality customer experience in its strategic goals.

Criteria: 1) customer experience with the agency’s services is listed in the strategic plan as one of the organization’s top priorities or a supporting goal of one of the priorities 2) the strategic plan provides specific actions the agency will take to improve customer experience. - Specifies customer feedback as a key measure of the organization’s performance.

Criteria: There is a performance measure included in the agency’s strategic plan, annual performance report or agency priority goals that is based on feedback directly from customers. - Has a senior executive with the responsibility and authority to lead efforts to improve customer experience across the organization.

Criteria: Based on a review of the agency organizational chart and online descriptions of leadership positions, the agency has an executive who meets the following criteria: 1) customer experience is his or her primary responsibility 2) he or she reports to the head of the organization or a deputy 3) his or her work spans all major service delivery channels (e.g., online services, contact centers, face-to-face services). - Shares meaningful customer feedback with the public.

Criteria: In alignment with the Office of Management and Budget’s guidance on customer experience measurement, the agency publishes customer feedback that: 1) represents multiple service delivery channels 2) provides details into different aspects of the experience (e.g., beyond overall customer satisfaction).

Customer Service Basics

For the most common services provided, customers can:

- Complete online frequently used transactions.

Criteria: Based on a review of the agency’s website, customers can complete major services or transactions online. - Easily find information to call an appropriate representative.

Criteria: Does the agency’s website provide a clear explanation of which number to call for specific issues or provide one number that customers can call to get routed to the appropriate person. - Schedule in-person appointments.

Criteria: Based on a review of the agency’s website, customers can schedule appointments for in-person services. - Obtain status updates.

Criteria: Customers can get current updates through an online or self-service channel that includes estimated timelines on items such as submitted applications or benefit disbursements. - Find standardized and consistent information and guidance across channels.

Criteria: At least two service delivery channels have integrated knowledge management systems so that when content for customers on one channel is updated, it is updated on the other channel.

Customer Feedback

The agency collects and analyzes data and information on customer perceptions:

- Of specific interactions, including website visits, phone calls, and in-person appointments.

- Of the customer journey through a series of interactions or multi-stage processes that build toward a specific goal.

- Of the service provided by the organization overall.

- Through qualitative research, such as customer interviews, focus groups or direct observation.

- Through a structured analysis of comments about the service left on social media channels.

This customer experience profile was produced in collaboration with Accenture Federal Services.